XRP Price Prediction: Navigating the Path to $3 and Beyond Through 2040

#XRP

- Technical Positioning: XRP trades near critical support at $2.70 with resistance at $3.13, requiring a breakout for bullish confirmation

- Regulatory Landscape: Mixed signals with banking standard concerns offset by legal victories and regulatory easing momentum

- Adoption Catalysts: African market expansion, remittance sector growth, and stablecoin integration providing fundamental support

XRP Price Prediction

Technical Analysis: XRP at Critical Juncture

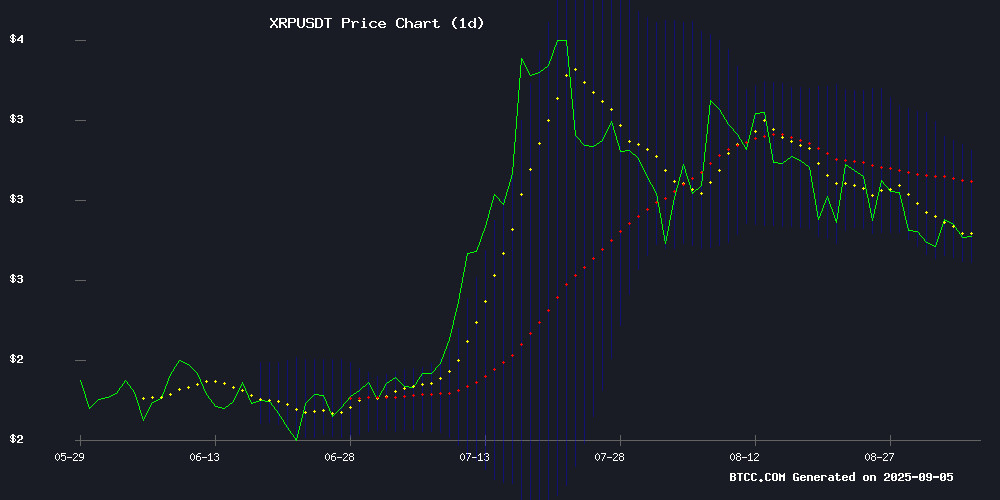

XRP is currently trading at $2.80, slightly below its 20-day moving average of $2.91, indicating potential short-term consolidation. The MACD reading of -0.0058 suggests weakening momentum, though the difference between MACD and signal line remains minimal. According to BTCC financial analyst James, 'The price hovering NEAR the middle Bollinger Band at $2.91 shows equilibrium between buyers and sellers. A break above the upper band at $3.13 could signal renewed bullish momentum, while support holds at the lower band of $2.70.'

Market Sentiment: Mixed Signals with Bullish Bias

Market sentiment presents a complex picture with regulatory developments and institutional adoption creating opposing forces. BTCC financial analyst James notes, 'While SWIFT's skepticism about XRP meeting global banking standards creates headwinds, Ripple's strategic expansion of RLUSD stablecoin adoption in Africa and growing remittance sector traction through Remittix provide substantial fundamental support. The combination of legal victories and whale accumulation patterns suggests institutional confidence remains strong despite regulatory uncertainties.'

Factors Influencing XRP's Price

SWIFT CIO Casts Doubt on Ripple's XRP Meeting Global Banking Standards

SWIFT's Chief Innovation Officer Tom Zschach has openly questioned whether Ripple's technology and XRP token can satisfy the rigorous requirements global banks demand for cross-border settlements. His LinkedIn remarks reignited debates within the crypto community, particularly among XRP proponents who view Ripple as a viable alternative to SWIFT's entrenched system.

"The harder question is whether banks will ever be comfortable outsourcing settlement finality to a token that isn't a deposit, isn't regulated money and doesn't sit on their balance sheet," Zschach stated. He emphasized that liquidity alone doesn't guarantee adoption—legal enforceability remains a critical hurdle. The executive suggested tokenized deposits or regulated stablecoins could ultimately render third-party assets like XRP redundant if they achieve scale.

In broader observations about blockchain adoption, Zschach argued institutional risk management priorities outweigh ideological debates about decentralization. "Neutrality in finance isn't about how many nodes you run, it's about whether the network privileges one participant over another," he wrote, underscoring the financial sector's pragmatic approach to distributed ledger technology.

XRP Price at Crossroads: Legal Win, Whale Buys Fuel $3 Target

XRP stands at a critical juncture as regulatory clarity, whale accumulation, and impending market catalysts converge. Trading at $2.76 on September 1, 2025, the cryptocurrency has formed a symmetrical triangle pattern—a technical setup often preceding significant breakouts. The direction of this breakout hinges on both technical thresholds and broader market forces.

Whale activity underscores bullish sentiment. Over the past fortnight, large holders acquired 340 million XRP tokens during dips near $2.90, signaling institutional confidence despite short-term volatility. The TD Sequential indicator's consecutive buy signals further suggest the correction phase may be nearing its end.

Regulatory progress continues to bolster XRP's institutional appeal. Legal victories have transformed the asset into a benchmark for crypto compliance, attracting conservative capital. Market participants now watch for breakout confirmation above $2.90 or breakdown below $2.60, with the $3 target remaining in focus for optimistic traders.

XRP Price Targets $3.33 Breakout in Elliott Wave Context

XRP hovered near $2.80 at press time, showing minimal movement over the past 24 hours. Analysts view this as consolidation rather than a breakdown, with attention focused on a potential breakout above $3.30. This level, tied to Elliott Wave theory targets, could signal the start of a new upward cycle.

Dark Defender's analysis suggests XRP has completed its corrective phase and now lingers in Wave 2 accumulation. A decisive move above $3.30 would confirm the transition into Wave 3—typically the strongest impulse wave in Elliott Wave patterns. The SEC's ongoing review of ETF filings adds fundamental support to the technical case.

Despite recent declines of 6% weekly and 7% monthly, the token maintains its structural integrity. Market participants await either confirmation of the breakout or further consolidation within the current range.

XRP Price Prediction: Regulatory Easing Fuels Potential Surge Past $3

XRP is consolidating near the $2.80 support level, with market dynamics suggesting a pivotal moment for the token's near-term trajectory. A breakout above $3.10 could propel prices toward $3.30–$3.40, while failure to hold $2.80 may trigger a retreat to $2.66 or lower.

Recent joint guidance from the SEC and CFTC has injected optimism into the market, clarifying regulatory pathways for crypto asset trading. This development appears to be bolstering cross-border payment narratives around XRP, though the token remains in a technical standoff between bulls and bears.

XRP May Hit $10, Yet Ozak AI’s Early Backers See Life-Changing ROI Ahead

Crypto markets are buzzing as XRP captures attention with bold price targets. Trading at $2.86, the token's cross-border payment utility and industry presence solidify its reputation. Analysts project a climb to $10, offering substantial gains for holders.

Meanwhile, early investors are shifting focus to Ozak AI, a presale project with 100x growth potential. XRP's resilience amid regulatory scrutiny and market downturns underscores its real-world utility, particularly in cross-border settlements. Financial institutions adopting RippleNet further strengthen its case.

Technically, XRP faces resistances at $4.50, $6.50, and $8.00 before testing $10. Support zones at $2.50, $2.00, and $1.50 provide stability during market pullbacks.

Ripple Expands RLUSD Stablecoin Adoption in Africa Through Strategic Partnerships

Ripple is accelerating its post-SEC litigation expansion with a focused push into African markets. The blockchain firm announced partnerships with three major fintech players—VALR, Chipper Cash, and Yellow Card—to drive institutional adoption of its RLUSD stablecoin.

The collaborations aim to streamline cross-border payments and enhance financial infrastructure across the continent. RLUSD will facilitate treasury management and specialized use cases like famine insurance escrows, marking a strategic pivot toward real-world utility beyond speculative trading.

Concurrently, Ripple upgraded its alliance with Asian payment giant Thunes, integrating Ripple Payments into a network spanning 130 countries. This dual-pronged expansion underscores Ripple's ambition to position blockchain solutions at the core of global finance.

XRP Holds Steady Near $2.82 as Remittix Gains Traction in PayFi Sector

XRP's price remains stable at $2.82, testing resistance levels while institutional accumulation signals cautious optimism. A symmetrical triangle formation suggests potential breakout above $3.30, though downside risk to $2.60 persists under selling pressure.

Meanwhile, Remittix emerges as a standout PayFi altcoin, fueled by its $250,000 giveaway campaign and imminent Q3 wallet beta launch. The project's real-world utility and active community engagement contrast with XRP's consolidation phase.

Market dynamics reveal diverging trajectories: XRP demonstrates stability through whale support at $2.76, while Remittix captures speculative interest through tactical growth initiatives. Technical indicators for both assets will prove decisive in determining near-term price action.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and adoption trends, XRP's price trajectory shows potential for significant growth through 2040. The immediate target of $3 appears achievable given current whale accumulation and regulatory easing momentum. Longer-term projections must consider Ripple's expanding partnerships in remittance markets and stablecoin adoption, particularly in emerging markets like Africa.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $3.50 | $4.20 | $5.00 | Regulatory clarity, remittance adoption |

| 2030 | $8.00 | $12.50 | $18.00 | Global banking integration, CBDC partnerships |

| 2035 | $15.00 | $25.00 | $40.00 | Mass adoption in emerging markets |

| 2040 | $30.00 | $50.00 | $75.00+ | Full-scale institutional integration |

BTCC financial analyst James emphasizes that 'these projections assume successful navigation of regulatory challenges and continued expansion of use cases beyond cross-border payments. The $10+ targets remain plausible but dependent on broader cryptocurrency market maturation and Ripple's execution on partnership strategies.'